Overview

Zype

Reimagining borrowing by creating a transparent, flexible and rewarding personal credit experience built around real user needs.

Company:

Zype · Employer: HumanX (Full-time)

Domain:

FinTech, Lending, Personal Finance

Timeline:

4 weeks, design sprint

Platform:

Mobile, Android first

Responsibilities:

UX Research, JTBD Synthesis, IA, User Flows, Wireframes, UI Design, MVP Scoping

Team:

Manushri Dave · UX Designer

Manushri Dave · Product Designer

Tarun J · Lead UX Designer

Devang · Co-founder @ HumanX

The Result

The redesigned experience helped Zype strengthen user trust, improve borrowing clarity, and scale adoption, validating both the JTBD-led strategy and rapid execution during the sprint.

Zype is rethinking how young Indians borrow, spend, and manage money. While most lending apps compete on higher credit limits, users are actually looking for clarity, control, and confidence. During a focused 3-week sprint, we reframed borrowing around real-life financial moments, mapped user motivations and outcomes, applied the Jobs To Be Done framework, and designed a unified borrowing dashboard that could scale into a broader financial ecosystem.

Borrowing in India often feels stressful and opaque. Young earners juggle multiple apps for payments, credit, and budgeting, which fragments their financial understanding. Zype identified an opportunity to go beyond one-time loans and support the full financial journey prioritizing transparency, trust, education, and personalized insights over just higher limits.

The product has since grown to 3.5M+ downloads, 22.8K+ reviews, a 3.9 Play Store rating, and over 2L loans disbursed, positioning Zype as one of India’s leading instant credit platforms.

The Problem

Users frequently choose competitors because of higher credit limits. The team needed to understand:

If Competitor X offers Rs 200 credit and Zype offers Rs 150 credit, why would a user still choose Zype

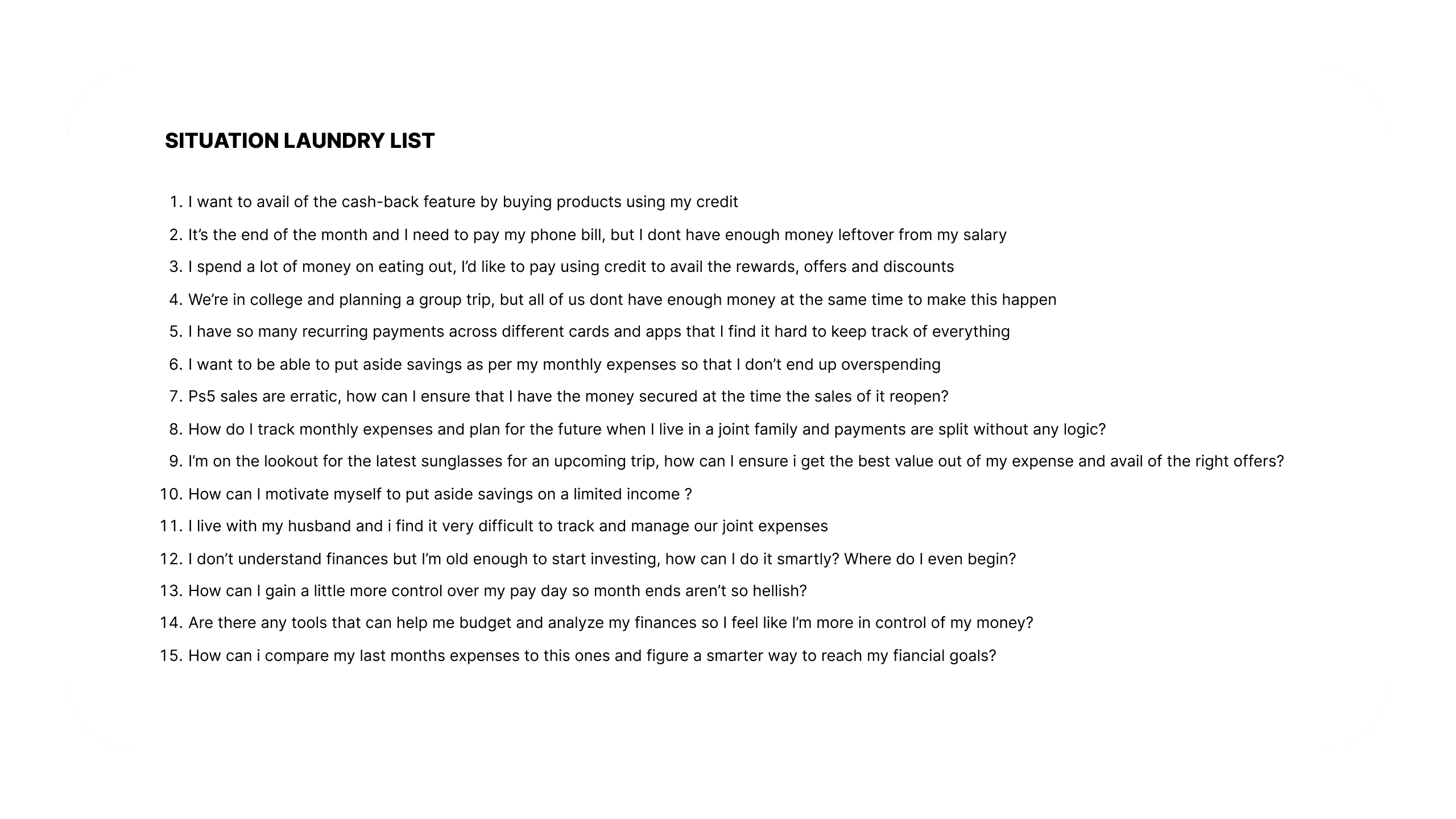

We uncovered more than 15 real money situations that showed that value is not driven by limits alone. It is driven by how well a product fits into a user’s financial life.

Stakeholders

Primary stakeholders

• Leadership, founders

• Design team

• Credit and risk teams

• Growth and data teams

Secondary stakeholders

• Bank partners

• Customer support

• Regulatory teams

This alignment ensured the product was desirable for users, feasible for engineering and viable for the business.

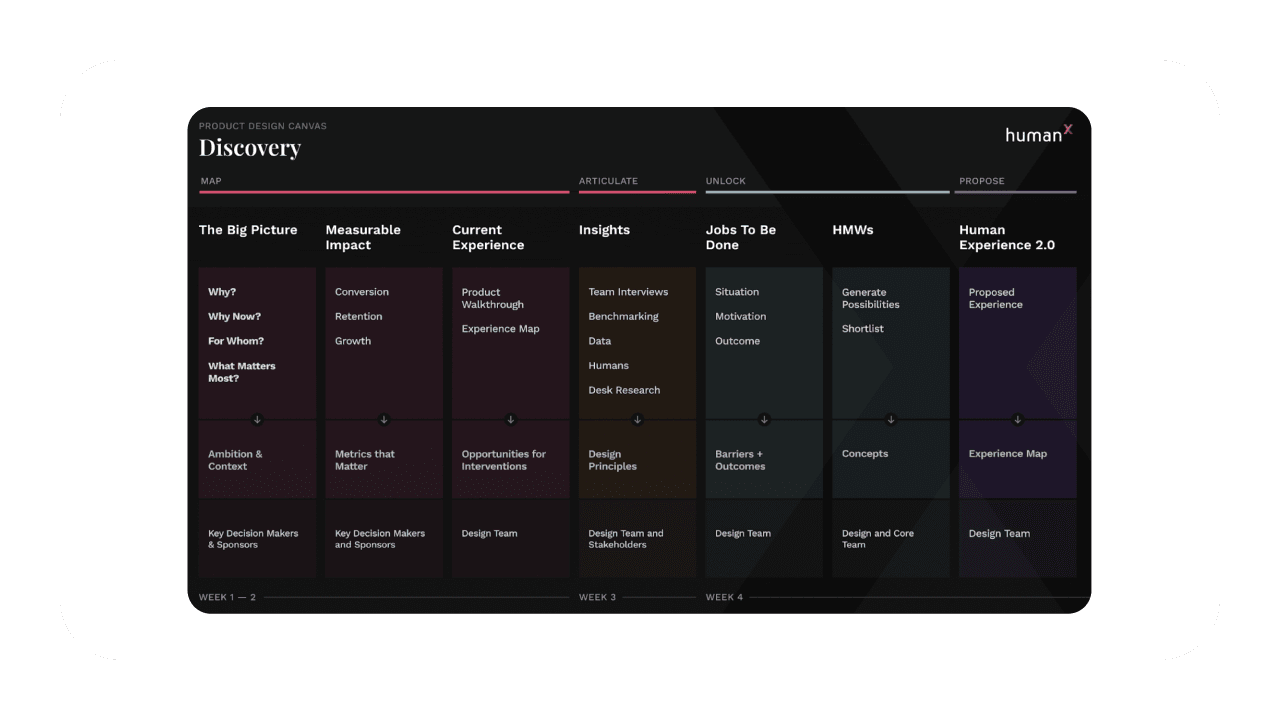

Zype was built using a structured yet flexible process inspired by the Double Diamond and HumanX’s Product Design Canvas. We started by understanding real financial contexts—when users borrow, why they hesitate, and what “good” looks like beyond higher limits. Research, JTBD synthesis, and benchmarking helped us reframe the problem around real-life money moments rather than features.

From there, we translated insights into clear product structure, flows, and an MVP scope, validating decisions through rapid prototyping and testing. The result was a human-centered experience that balanced speed with clarity and trust, while remaining scalable for future growth.

Secondary & Industry Research

Indian Digital Lending Landscape

India’s digital lending ecosystem has grown rapidly over the last decade, driven by smartphone penetration, UPI adoption, and a young, credit-hungry population. According to RBI and industry reports, over 60% of first-time borrowers in India are under the age of 35, many of whom lack formal credit histories and rely on instant credit apps to manage short-term cash flow.

However, this growth has also exposed structural gaps:

Lending products are often transaction-focused, not relationship-driven

Users struggle to understand interest rates, repayment timelines, and total cost of borrowing

Financial products prioritize credit limits over financial clarity

Many users juggle 3–5 finance apps for borrowing, payments, and tracking expenses

This fragmentation increases stress and reduces trust especially among young earners and first-time borrowers.

Shift from “Credit First” to “Confidence First”

Market research across fintech and consumer lending shows a clear shift in user expectations:

Users are no longer optimizing only for maximum credit

They increasingly value:

Predictability over flexibility

Clarity over complexity

Control over aggressive upselling

Studies indicate that users who understand repayment behavior, spending patterns, and future impact are more likely to:

Repay on time

Reuse the platform

Trust the brand long term

This positions design not just as an interface layer, but as a risk mitigation and retention tool.

FinTech Behavior Trends Among Young Indians

Secondary research across fintech platforms revealed consistent behavioral patterns:

Credit is often used for lifestyle smoothing, not emergencies alone

Users think in moments, not financial products

Financial anxiety is high

This reinforced the need for low-cognitive-load design and contextual guidance rather than feature-heavy dashboards.

To ground Zype in real financial behavior we mapped Jobs To Be Done across multiple everyday money moments. Instead of designing features in isolation, we looked at why, when, and for what outcome users turn to credit and financial tools.

We identified and documented JTBDs across key categories including Credit & Shopping, Emergency Credit, Splitting Expenses, Budgeting & Analyzing, Everyday Shopping, and Gifting. Each category captured distinct situations users find themselves in, the motivation behind their actions, and the outcome they are trying to achieve.

This approach helped us move beyond “loan use cases” and design for broader lifestyle needs whether it was managing end-of-month cash flow, handling emergencies, tracking spending, or making thoughtful purchases. Below are a few representative examples that informed core product decisions, flows, and feature prioritization.

Defining the Opportunity

Users want

• instant liquidity

• simple repayment plans

• spending clarity

• personalized insights

• lower cognitive load

• a trustworthy partner for both emergencies and lifestyle goals

Opportunity Statement

Create a borrowing ecosystem that supports a user’s entire financial life from borrowing to spending to analyzing to investing.

Persona

To design a borrowing experience that feels supportive rather than stressful, we grounded Zype around two core user mindsets that represent different stages of financial confidence and intent.

Information Architecture

The IA was designed to reduce cognitive load by organizing the app into four clear pillars: Borrow, Spend, Analyse, and Invest. Primary actions were surfaced contextually based on user needs, while secondary features remained accessible without cluttering the experience. This structure enabled users to quickly orient themselves, understand their financial position, and take action without feeling overwhelmed.

Wireframes

Wireframes focused on clarity, speed, and reassurance. Key decisions included minimizing scroll depth, simplifying decision points, and surfacing need-based CTAs like “Draw Cash” or “Repay Now” at the right moments. Modular layouts allowed features to scale over time while keeping the core experience predictable and easy to use.

Visual Identity & Design System

Final UI Designs

Feedback

"I had a smooth experience using the Zype app for an instant loan. The application process was simple, the verification was quick, and the loan was approved within minutes without any complications. The UI is clean and easy to use, and the disbursement was prompt. Really impressed with how fast and transparent the process is. Definitely a reliable option when you need urgent funds."

Akhil vijayan

Zype User

Prototype

Reflection

Designing for personal finance reinforced the importance of clarity over persuasion. Users were not looking to be convinced to borrow they wanted to feel informed, in control, and respected.

The project highlighted how small design decisions language, ordering, defaults directly influence trust and financial behavior. Choosing to prioritize transparency sometimes meant intentionally de-emphasizing higher limits or aggressive nudges in favor of long-term confidence and retention.

Working within a tight sprint also sharpened decision-making. Every feature and interaction had to earn its place, which led to a more focused MVP and a system that could scale without becoming overwhelming.

This project reaffirmed that strong financial products are built not by maximizing options, but by reducing anxiety and helping users make better decisions at the right moment.